The Supervisory Board of Luka Koper d.d. has on its session on 23rd November 2023 approved the Group’s and Company’s business report for the first nine months of the year, the performance estimate for 2023 and the business plan for 2024.

Luka Koper performed well in the first nine months of 2023, with all financial indicators exceeding the plans set for the period. Net sales revenue amounted to EUR 233.9 million, which is at the same level as in the same period last year, and 8% or EUR 17.8 million above the planned figure. The increase in revenue was due to higher container and car throughput, higher volumes of container stuffing and stripping services and higher service prices, while warehousing income was EUR 17.8 million lower due to the gradual easing of the global logistics situation and shorter holding times for goods in warehouses. The operating profit (EBIT) achieved up to and including September amounted to EUR 51.6 million, exceeding the plan by 92% or EUR 24.7 million. It was driven by higher net sales revenue and 3% or EUR 6.2 million lower operating costs than planned. EBIT was nevertheless lower than in the same period last year due to lower warehouse income and higher costs resulting from inflationary pressures, additional recruitments and changes in the structure of the business. EBITDA was also 47% higher than planned, at EUR 76.1 million as at 30 September.

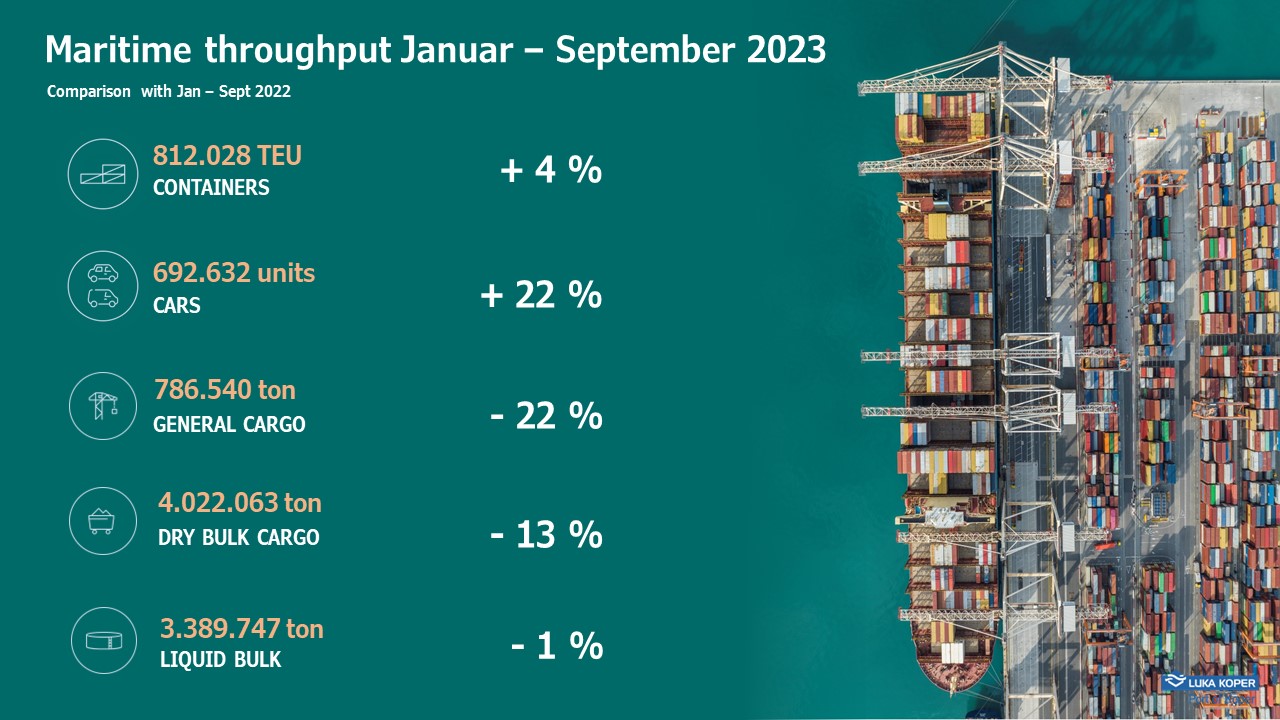

“Despite different forecasts, the global economy is recovering more slowly than expected. The logistics situation remains complex, with container ship arrivals still delayed both on direct connections to the Far East and to ports in the Mediterranean, and freight rates are gradually falling. Shipowners are forecasting reduced services from the Far East for the end of the year, while ports in Europe are facing high occupancy rates at car terminals. The potential escalation of the conflict in the Middle East poses an additional risk to the flows of goods passing through the Suez Canal. Nevertheless, we performed above expectations and recorded growth in throughput in both strategic commodity groups,” said Nevenka Kržan, President of the Management Board at Luka Koper, at the end of the January-September period. The Container Terminal handled 812 thousand TEUs, a 4% increase compared to 2022, while the Car and RO-RO Terminal handled 692.6 thousand vehicles, a 22% growth. Total throughput was 16.8 million tonnes, slightly lower than expected.

In the first nine months, we concluded two major investments – the surface arrangements of the Cassette 5A storage area and the construction of new plug points for reefer containers. By the end of the year, we expect to complete the construction of a new external Truck Terminal at Sermin and the upgrade of the cooling and firefighting system on the methanol tanks. Activities are also underway for the construction of the twelfth mooring place in Basin 2, steel product storage 54 and two 3-megawatt solar power plants, as well as activities for dredging the seabed and test transfer of marine sediment.

Estimate of business performance: operating profit 40% higher than planned

We entered 2023 optimistic, but the forecasts on expansion of economic activity did not quite materialise. The economic recovery was slower than anticipated and growth moderated during the year. Nevertheless, Luka Koper Group performed well and looks set to finish the year above expectations. According to the estimate, net sales will amount to EUR 302.8 million, which is 4% or EUR 12.7 million higher than planned. Warehousing revenues were down compared to 2022 due to a gradual easing of the global logistics environment and shorter dwell times in warehouses. The expected lower warehousing income and the increase in costs due to inflationary pressures will also have an impact on the EBIT achieved by the end of the year, which will amount to EUR 49.1 million, 42% or EUR 14.5 million above the target. Net profit will also be 40% or EUR 12.8 million higher at EUR 45.1 million.

We will see growth in both strategic commodity groups compared to 2022. Container throughput (TEUs) will be 1,061 thousand TEUs, up 4% on 2022, while car throughput (units) will be 11% higher than in 2022 with 893 thousand vehicles, exceeding the planned volumes for 2023. In the general cargo segment, the trend towards containerisation of wood continues, liquid cargoes will be characterised by lower throughput of petroleum products in 2023, while dry bulk cargo will be slightly lower at the expense of soya beans, alumina, phosphates, coal and iron ore. Total maritime throughput (in tonnes) is expected to reach 22.1 million tonnes by the end of 2023.

2024: Higher throughput and business growth

The outlook for 2024 is very promising, with the world economy projected to grow by 2.9% and inflation expected to fall to around 3% by the end of the year. We also expect moderate growth in global container throughput and higher car sales. Luka Koper Group’s business operations will also be affected by investment and maintenance works on the Slovenian railway network, which will continue until the construction of the second railway line in 2026.

Luka Koper Company will perform well in 2024 and will achieve a net sales revenue of EUR 320.9 million. This will be slightly higher – EUR 324.5 million for the Luka Koper Group, representing a 7% growth compared to 2023. The higher net sales revenue will be driven by the projected growth in throughput and sales prices. The EBIT of the Company and the Luka Koper Group will also be 3% higher, although operating costs will be higher due to inflation and new recruitments. Compared to 2023 estimate, the Company’s and the Group’s 2024 net profit will be 8 and 7 percent higher respectively.

We will deliver growth in all segments. In the container segment, we will record a 3% growth with 1,093 thousand TEUs, and in the car segment, we will remain at the 2023 level with 895 thousand vehicles. With the planned growth in the other commodity groups, the total throughput (in tonnes) will increase by 2% to 22.6 million tonnes in 2024, compared to 2023.

The investment plan for 2024 of Luka Koper d.d. and the Luka Koper Group is in line with the objectives set out in the Strategic Business Plan. The key investment projects in 2024 will be related to the continuation of activities to increase the capacity of the Container Terminal, the construction of additional open storage areas for car handling, the increase of storage capacity for general cargo, the construction of a new Passenger Terminal, the construction of solar power plants on the roofs of existing warehouses, the construction of a Fire Station and the purchase of equipment. In 2024, Luka Koper Group will spend EUR 21 million on sustainable development and social responsibility projects, representing 32% of total planned investments.